Heights Price Trends

Heights home prices have a lot of variables of course, but the two big decisions a buyer has to make are location and new vs. old. After you narrow down the location you have to chose between new (or at least built in last 10 years or so) or old. New is typically tall and skinny on small lots; old is smaller, but on big lot. Below are some some charts on price trends in the Heights. Deciding on old vs new/recent may be a difficult choice for some of you. Here is an old post I did comparing Old vs. New. The post is several years old and prices don’t relate, but the comparison is still valid.

Resale Home Prices

Home prices are complicated.

Each area has different lot sizes and differing levels of desirability.

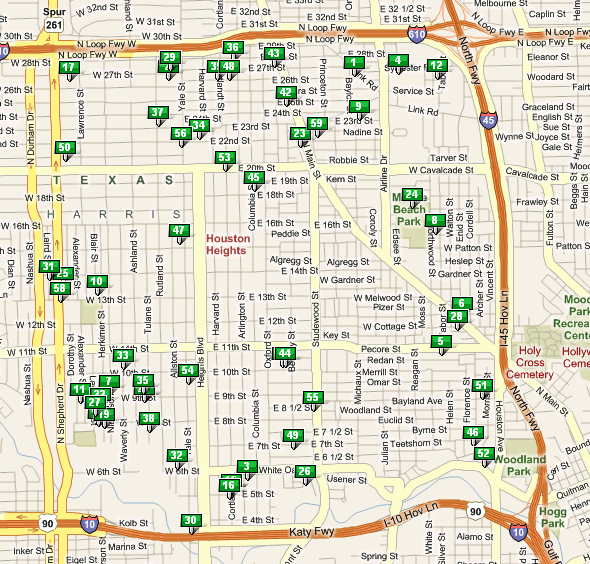

Woodland Heights and the core area of Houston Heights are the most sought after. The areas nearer the edges, i.e. Heights Annex, Sunset Heights, Brooke Smith are not as pricey. So, in looking at prices be sure to compare apples to apples.

The table below gives prices for resale homes – not new homes or even recent homes. These are all older homes that have been remodeled. These are mostly Victorians and Craftsman bungalows from the 1910’s and 1930’s. I deleted most of the newer homes because they generally were built on smaller lots (2 houses where previously there was one).

| Houston Heights Homes-Resale 1st Q 2015 | ||||||

| Description | Price Range | House SF | Lot Size | Price/SF | DOM* | SP/LP** |

| 1 Bath Homes | $335K-$530K | 966-1602 SF | 4356-6600 SF | $287-$469/SF | 14 | 1 |

| Avg. | $420.4K | 1170 SF | 5372 SF | $359/SF | ||

| 2 Bath Homes | $452K-$990K | 1358-2534 SF | 4300-7836 SF | $255-$347/SF | 28 | 0.99 |

| Avg. | $677K | 2186 SF | 6176 SF | $310/SF | ||

| * DOM = Days on Mkt. | **LP/SP = Ratio of List Price to Sales Price | |||||

I don’t expect any softening of prices with the oil price slump, but I do expect the last two columns to change. Days on Market should slowly edge back toward historical 90 days; and the ratio of list price to sold prices should drop a little (96%-97% were the norm in years past).

New Home Prices on Small Lots

New home prices can’t all be lumped together; they have to be sorted by land size and location. In the suburbs the difference in home prices isn’t affected much by lot size. If you have a lot 3000 SF bigger than your neighbor’s its only $3/SF more, so no big deal. In the Heights where land is $50-$80/SF, a big lot makes a huge difference in price. For this reason I have sorted out new construction homes on full sized lots (4500+ SF) from those with smaller lots. Other homes written about in other posts.

New Homes on Small Lots (2500 -3500 SF lots).

| Houston Heights New Home Prices – 1st Q 2015 | |||||

| Description | Price Range | House SF | Lot Size | Price/SF | SP/LP* |

| Sold in 1st Q | $607K-$931K | 2470-3042 SF | *** | $216-$306/SF | 1.01 |

| $684K Avg. | 2668 SF Avg. | 3238 SF Avg. | $256/SF Avg. | ||

| *LP/SP = Ratio of List Price to Sales Price | |||||

A couple of notes about table above.

Homes on smaller lots typically are of two styles:

- Garage-front: If there is no alley access, then the home is normally front-loading. There is no alley access for the garage, and the lot is too narrow to allow a driveway. Thus the only option is for the garage to face the street and the house be built above and behind it.

- Porch-front: If there is an alley behind the house, then a typical “Heights style” home can be built…porches in front; detached garage behind.

When buying, one of the options you have is bigger homes on smaller lots (the homes discussed here), or smaller old homes on big lots.

There are no mass builders at this price point. There were 3 big homes sold in 1st Q and 21 on the market or being built now. These 24 homes were built by 17 builders…thus 1 or 2 homes is typically all a builder is making in this price range.

One other thing worth noting: The average price per SF ($310/SF) is the same for new homes. This has historically been true. Prices are equivalent for gorgeous remodels and for new homes (with location and lot sizes being equal).

Big New Homes on Large Lots

The table below shows early 2015 prices of these big homes, pricing starting at $1M. The Heights has never been a location for high density homes. As land prices continue to escalate though more homes are being built in communities with a common drive. Less land cost means lower prices. Some high end condos are being built too. These are typically built around the edges of the Heights.

| Houston Heights New Home Prices – 1st Q 2015 | |||||

| *LP/SP = Ratio of List Price to Sales Price | |||||

| Description | Price Range | House SF | Lot Size | Price/SF | SP/LP* |

| Sold in 1st Q | $1.25M-$1.36M | 3616-4257 SF | 6600 SF | $294-$342/SF | 1 |

| $1.31M Avg. | 3952 SF Avg. | 6600 SF Avg. | $331/SF Avg. | ||

| Available | $775K-$1.65M | 2619-4265 SF | 5000-6600 SF | $296-$406/SF | N/A |

| New Homes | $1.2M Avg. | 3564 SF Avg. | 6056 SF Avg. | $310/SF | |

Prices for Land

Land prices have doubled over the last couple of years. $80/SF is not uncommon in parts of Houston Heights and Woodland Heights. Even Sunset Heights is $55-$60/SF. This is very popular for new homes. Brooke Smith used to be very affordable, but $50/SF is about the going rate now.

Subscribe to my blog to be notified of updates.

- Oak Forest Home Prices

- Lindale Park Home Prices & Sales

- Sunset Heights Home Prices

- Brooke Smith Home Prices

If you have any questions please feel free to contact me at 713 868-9008

Houston Heights Price Trends & Surrounding Neightborhoods

Houston Heights Price Trends The Houston Chronicle issued it’s yearly Subdivision Price Trends on 04/11/10. I extracted data for areas near the Heights,and surrounding neighborhoods in table below. Don’t look too closely at the price trends if there are very few sales. Woodland Heights for example (where I live) shows a decline in price. What […]

Looking for Land in Houston Heights Area?

Looking for Land in Houston Heights? Mid 2014 Note: This is a post from early 2010. I keep it here because it seems almost quaint and charming. Land was easily available then, but impossible to find now. Prices are twice the values described here. Most Heights land is done off MLS. Contact me or my […]

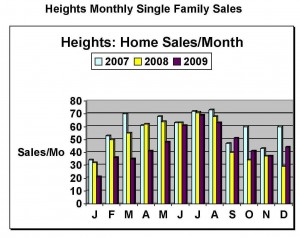

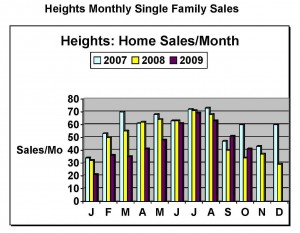

Heights Home Sales & Market Update.

Heights Home Sales Heights home sales had an end-of-year bump in December. This had been typical in years past as buyers rushed to take ownership by year-end for the property tax break. (If you don’t own it as of January 1st, you don’t get the homestead exemption). 2008 was an exception to every rule however, […]

Houston Home Sales Show Gain…Or Do They?

Houston Real Estate Market Enjoys Second Consecutive Month of Positive Home Sales Volume. The headline above was quoted from a recent HAR.com press release. Big deal! Those two months were the aftermath of hurricane Ike…they sucked. We were all busy chasing Reliant Energy trucks down the street, begging to get power back on. Then we hunted tree trimmers […]

Houston Heights Home Prices – Part 2: Early 1900’s Homes

Can I Afford a Darling Little Craftsman Home in Houston Heights?

Everyone loves Houston Heights. Wonderful little Craftsman bungalows, stately Victorian homes, & the multitude of other styles of the early 1900’s. How are these priced?! Here is the answer.

Houston Heights New Home Prices – Part 1 New Homes

Houston Heights New Home Prices I will talk about Houston Heights resale home prices in a later post. This one specifically targets new, single-family homes. The big factor in prices of all Houston inner-loop construction is land cost. Land in the Heights runs from $25-$40/SF, depending on location. Thus a 66×100 ft lot can cost $165,000-$265,000. […]

Inner Loop Home Prices – Sticker Shock

Inner Loop Home Prices – Why so High? Why do these Houston Inner Loop Homes Cost So Much? January 31, 2014 notes: This is an old post, but the reasoning still stands. Land prices continue to go up, and so do house prices. See my Neighborhood Page on Houston Heights, and recent posts. I do […]

Heights Area Real Estate Market-Then & Now

Heights Area Real Estate Market-Then & Now January 2014 Update: This is a 2009 post. I keep it around to show what the market used to be like…the good old days. Back then I showed Days on Market (DOM) to be 6-7 months. The 2014 DOM is currently about 30 days. Here is a more recent […]

Connect

Connect with us on the following social media platforms.